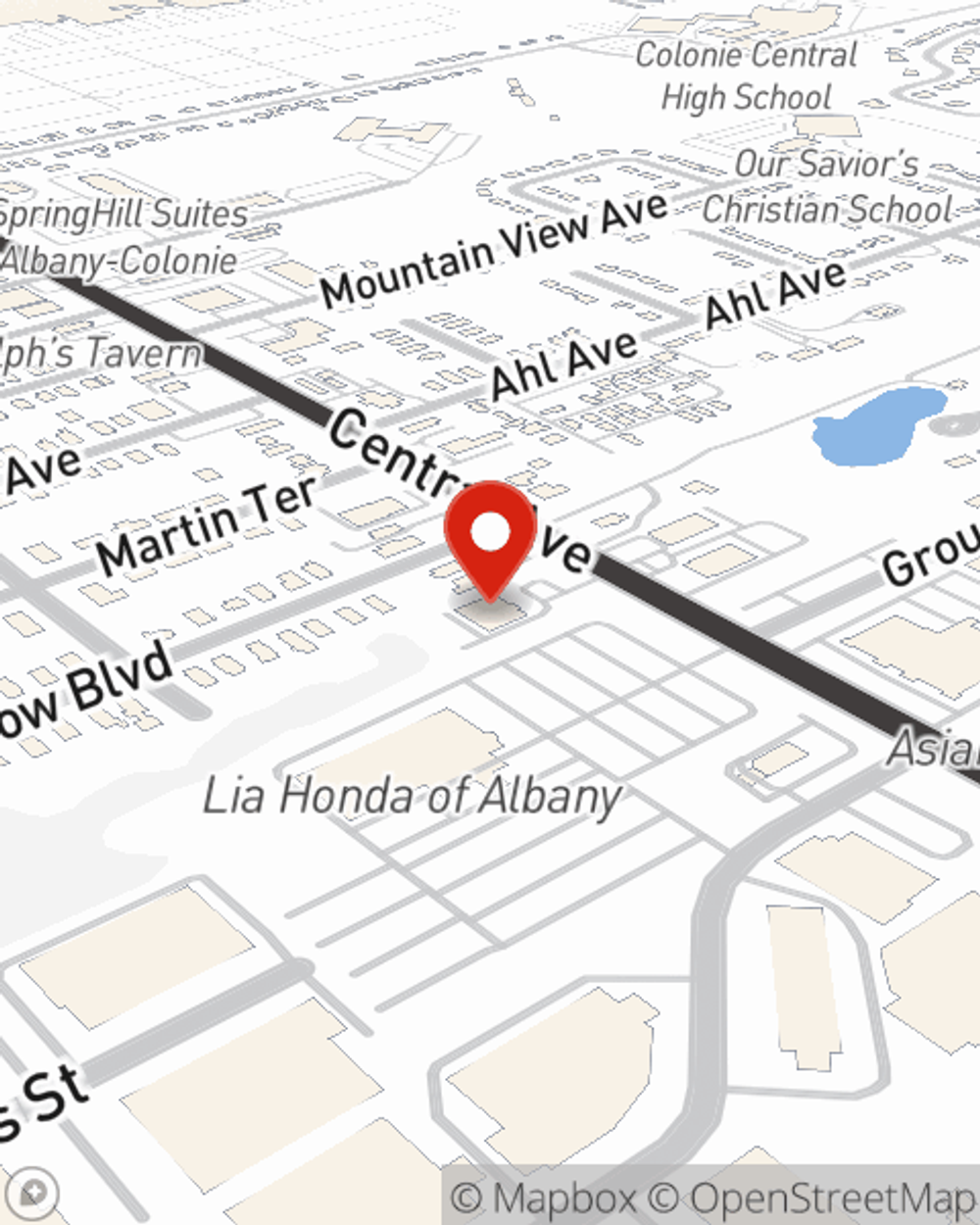

Renters Insurance in and around Albany

Your renters insurance search is over, Albany

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or house, renters insurance can be the most sensible step to protect your valuables, including your fishing rods, video games, bicycle, couch, and more.

Your renters insurance search is over, Albany

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

Renting is the smart choice for lots of people in Albany. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance may take care of a break-in that damages the door frame or an abrupt leak that causes water damage, who will repair or replace your belongings? Finding the right coverage helps your Albany rental be a sweet place to be. State Farm has coverage options to match your specific needs. Thankfully you won’t have to figure that out alone. With personal attention and reliable customer service, Agent Vernon Hinson can walk you through every step to help you set you up with a plan that shields the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Albany renters, are you ready to see how helpful renters insurance can be? Get in touch with State Farm Agent Vernon Hinson today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Vernon at (518) 459-8362 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Vernon Hinson

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.